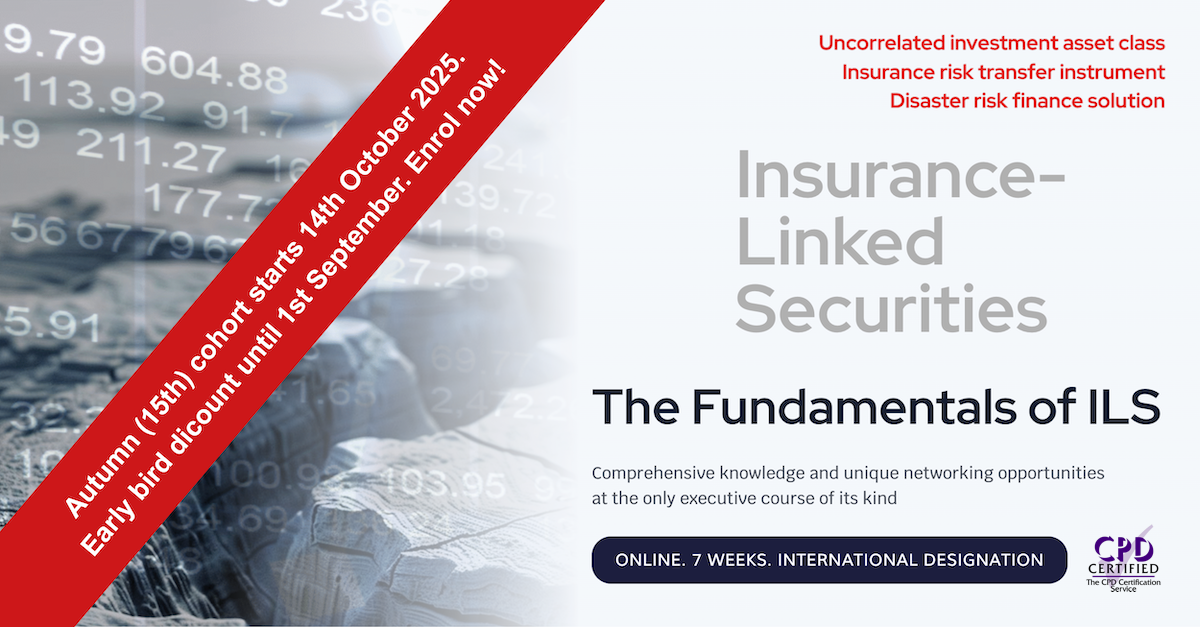

Our UK CPD certified Insurance-Linked Securities post-graduate programme will equip you with the knowledge and develop the skills necessary to work within the ever-evolving world of Alternative Risk Transfer (ART).

You will undertake a programme that takes a theoretical and practical approach to Insurance-Linked Securities (ILS), looking at what they are, how they are used, and the role they play in narrowing the gap between economic and insured losses.

Moreover, you will learn how this uncorrelated asset class offers diversification and Environmental, Social, and Corporate Governance (ESG) benefits to institutional investors. A particular focus will be placed on how ILS are used to transfer risk related to natural disasters and climate-related weather events along the Belt and Road Initiative (BRI).

- Teacher: Kirill Savrassov